In 2017, I wrote out a “thesis” (I know, very VC of me).

In it, I wanted to record to both the world and to myself, a promise that I was going to focus on founders building companies that give real people more agency over their lives.

Since I wrote that thesis, I’ve: completed 2 seasons of my podcast, had 1000s of discussions of entrepreneurs, made 394+ new investor “friends”, and supported 120+ companies in the Precursor portfolio. I’ve had all of my systems on overdrive to manage this growth both personally and professionally so thought it was time for some reflection.

Update #1: The underlying premise of my focus on “real people” still holds true to me.

This is unsurprising as I’ve spent the last 10 years of my career on this same beat. Whether it was advocating for low-income tax filers to the federal government or building a better CSR practice at a mid-stage company, I’ve always been interested in how to create systems that make this economic project of capitalism work better for everyone.

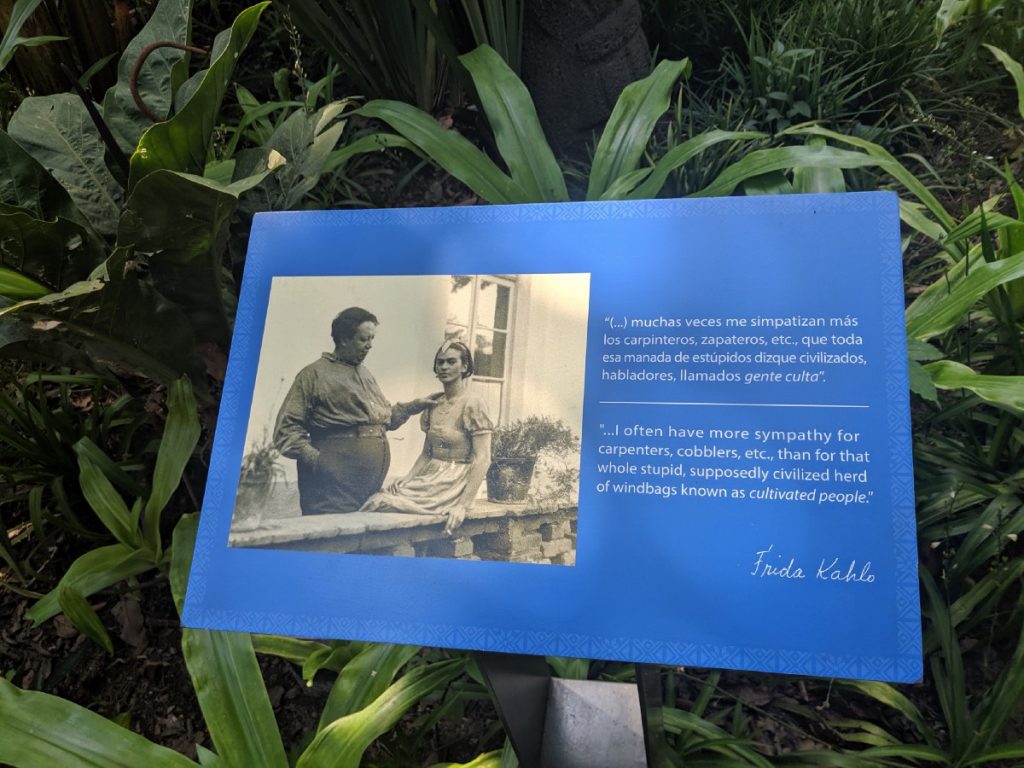

This is where I get the most energy, am most compassionate and think most creatively. In the words of Frida Kahlo:

Like Frida, I can get pretty insufferable — to others and myself — if I spend too much time thinking about things that are generally in vogue with cultivated people. Generally, I categorize these things in the following camps:

- Lofty ideas that have no likelihood of implementation — ie any conversation had at burning man

- Mediocre ideas that can squeeze more out of the “maker class” to make the “thinker class” richer

Update # 2: BUT, my thesis is too broad.

If I would have taken a look at the few companies I was really excited about I would have seen the trend clearly, but alas here we are. Better late than never. Both of the companies are focused not just on helping real people access more agency, but on fundamentally altering economic systems. Essentially, this is a version of the old adage:

Give Someone a Fish, and You Feed Them for a Day. Teach Someone To Fish, and You Feed Them for a Lifetime

How do these companies address economic systems change?

- Red Bay Coffee: They source coffee directly from the communities making it via direct trade. Their company is also a co-op where employees have ownership.

- Lacquerbar: They are focused on giving nail technicians — a group of workers who have been historically treated very unfairly — access to premier education that will help them access new opportunities within their industry. This access also unlocks a new more equitable way of building and operating nail salons.

My focus is here because my interest is here. I’m interested in solutions that fundamentally alter our economic system for the better. The incremental bores and frustrates me. Thinking in big picture gives me hope.

An additional piece to this is if you’re building an economic systems change, you have to be targeting the long-tail, a harder to reach population that has been negatively impacted by this system. I think this is a competitive advantage and a huge moat because aggregating this long tail is so difficult that others can’t figure it out and won’t be able to copy you.

I have, I think, a good eye for how this can be done in asset-heavy businesses; however, I think that this can be done in asset-light businesses as well.

I am on the hunt to find them so that we, at Precursor Ventures, can invest! If you are building one of these companies, please reach out.

Update #3: I’m realizing that my interests are different than most VCs which makes it even harder.

I’m trying to support the creation of something that is fundamentally different and untapped. This means that there are few current proxies for their success. When I was feeling down about this, it was really helpful to read this from Paul Graham at YC.

…the average investor is, as I mentioned, a pretty bad judge of startups. It’s harder to judge startups than most other things, because great startup ideas tend to seem wrong. A good startup idea has to be not just good but novel. And to be both good and novel, an idea probably has to seem bad to most people, or someone would already be doing it and it wouldn’t be novel. That makes judging startups harder than most other things one judges. You have to be an intellectual contrarian to be a good startup investor. That’s a problem for VCs, most of whom are not particularly imaginative. — Paul Graham

One thing I didn’t realize though was how difficult it would be to divert capital from a widely acceptable “good” investment to a very polarizing “amazing/terrible” investment.

This is ironic because I think it is this polarizing nature of companies that can become the bedrock of its success. Revolutionary ideas are hated by some and loved by others. That’s how some of the greats were made.

Google revolutionized access to information.

Apple revolutionized access to computers.

Square revolutionized access to banking.

Amazon revolutionized access to commerce.

Shopify revolutionized access to building online stores.

I’m looking to do something on the same scale and think that for it to be done, it can’t be left up to broad consensus.

So that’s where I am now… if this feels incomplete, it is because it is. Still working through this and looking forward to reporting back on more findings in the coming years 🤓